Public Net Worth

Accounting, Government and Democracy

“This important book…..is a call for sensible change. It should be answered” – Martin Wolf

An opportunity to improve long-term public finances

without cutting public services or increasing taxes.

Through better asset and liability management, government revenues can be increased significantly – by several per cent of GDP per annum

Accrual-based metrics also enable and encourage reduced costs, such as reduced interest costs through better debtor and creditor management.

“Just as a company or a household would look at their balance sheet when making investment decisions, so should a government.” – Andy Haldane

What is the opportunity?

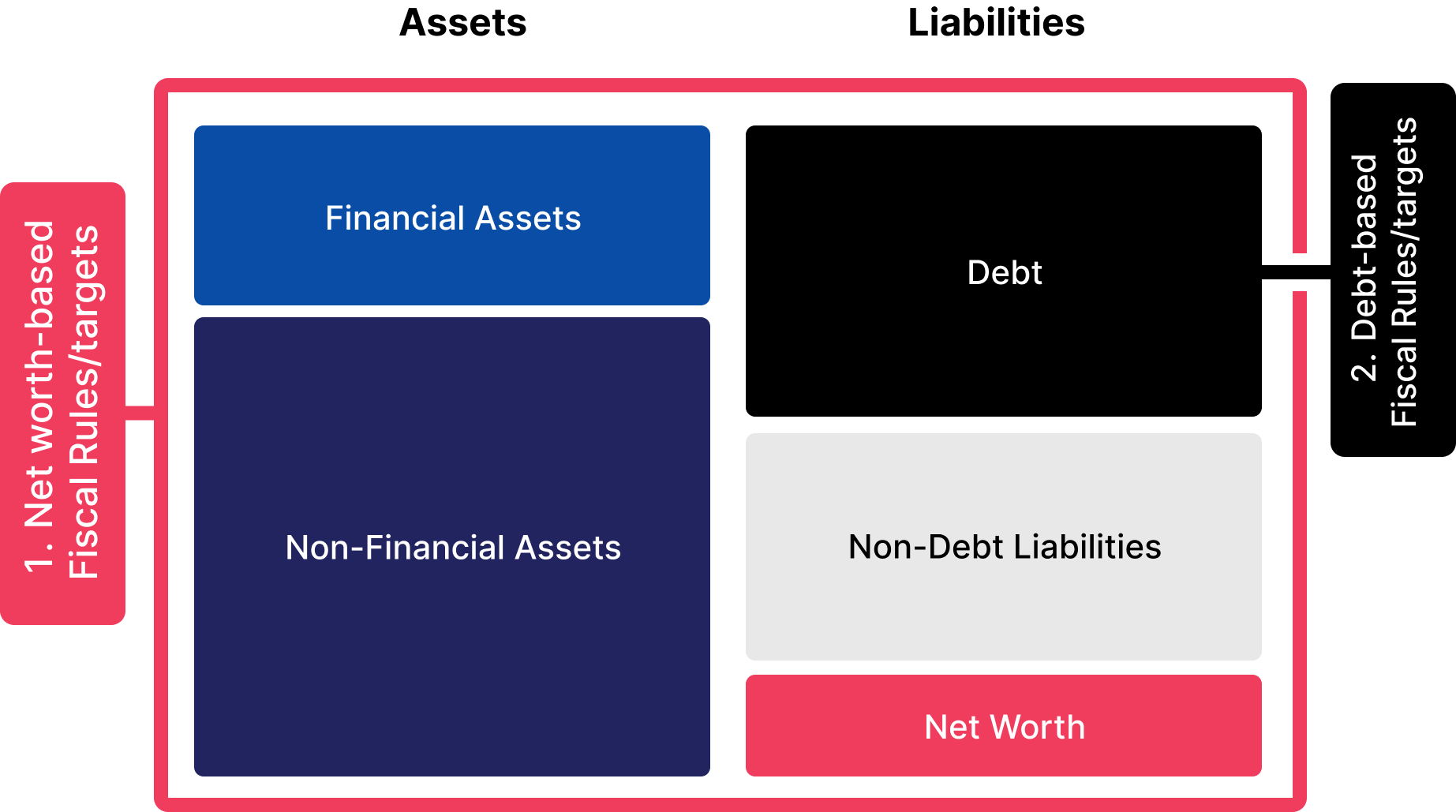

1. Adopting accounting-driven, Net Worth-based fiscal rules/targets creates major opportunities to improve long-term public finances without cutting public services or increasing taxes.

2. With a focus solely on debt and cash metrics, governments overlook the value of public assets and the full extent of liabilities. This narrow perspective leaves politicians without the necessary insight or accountability, leading to suboptimal use of resources and potential unfairness across generations.

Foreword by Martin Wolf

Chief Economics Commentator, Financial Times

“An excessively narrow focus on deficits can lead to bad decisions” ….

“The invention of modern accounting is among the most important advances in human history. Without it, today’s complex economies would be impossible.”

….”Government is a complex activity.”

Read the first chapter or order the book here!

Related articles

Beyond Debt: Net Worth Fiscal Anchors

Five Tips to Maximize the Impact of Assets and Liabilities on Public Financial Management

While liabilities, including debt – usually attract attention, they do not represent the totality of a government’s financial position. Recognizing the interplay between assets and liabilities in public financial management (PFM) can contribute to a stronger and more stable financial position.

Government Balance Sheets for better management of assets and liabilities

Government balance sheets allow governments and citizens to understand the fiscal impact of government policies in the immediate and long term. They help inform how decisions made today may have an impact on inter-generational equity

Meet the authors

Ian Ball

Willem Buiter

John Crompton

Dag Detter